It’s not How with data, it’s Why

Everyone is talking about data these days – how to collect it, analyze it, store it, monetize it – it’s become a very valuable corporate asset; in fact it’s rather common to hear the ‘data is the new oil’ analogy coming from corner offices and boardrooms across the country. That’s great and all, but we at thinktum have a different idea about all that data.

Data hoarders, unite!

Most carriers and other insurers sit on vast amounts of data – it’s automatically collected at every turn during interactions with potential customers, applicants, policyholders, and web and social media visitors. Every firm has grand plans to slice, dice, and julienne that data to their fiscal and business advantage. Sadly, what usually happens is the opposite. Firms start collecting data then realize how hard it is to understand, analyze, and truly use that asset – then it just turns into a hoarding situation all because they can’t figure out how to best utilize it now or even down the road. Better to gather and store it than to let it disappear into the data lake, untouched.

The trouble is, they are only thinking about the WHAT of data. At thinktum, we consider the WHY of data first, then move on to WHAT. And that makes all the difference in the world with regard to how useful that data really is.

Want to see into the future? Read thinktum and the future of insurance.

We offer the alternative

Instead of asking organizations and insurers how they’ll use the data, we begin the entire process with a simple question. What do you want to achieve?

| What you want | How to achieve it |

| Additional security measures | Build robust guardrails then use them |

| Frictionless customer journey | Start with liz flow – customizable e-app |

| More conversions or new business | Add on liz assess – triage & determinations |

| Ending misrepresentation | Install liz data for robust data analytics |

Once we get the answer, we roll up our sleeves and get to work. Because it’s not the HOW of data that’s important, it’s the WHY. We ensure your desired outcome is achieved by collecting the right data and providing it in a way that makes analysis easier and more robust. Here’s how.

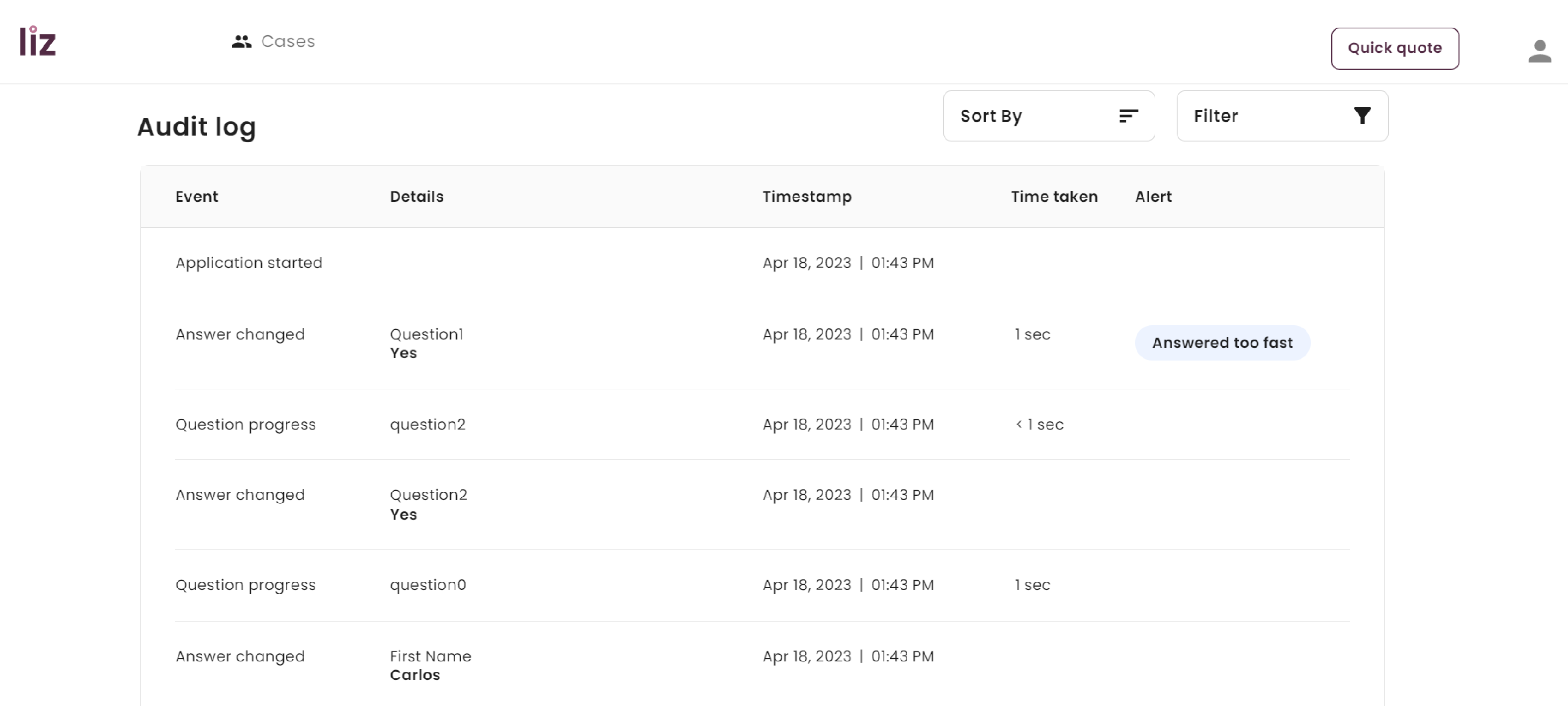

We ask the firms we speak with a simple question – what do you want to know? Then we direct the data collection to achieve that purpose. Now you can support your actions with facts, not assumptions or emotions with data analysis-driven actions. liz collects two types of data and that’s what makes the system so robust – it collects applicant data (the information provided as part of a customer journey) as well as behavioral data (how an applicant behaves during the customer journey). Most firms collect data and dump it into a repository for another day. Then that day arrives and they go in and try to analyze and manipulate the data into a usable asset. After a lot of shoehorning, the data can be coaxed into being valuable, in a roundabout sort of way.

But what if you begin with understanding what you want or need to know and then direct the data collection to meet your goals? That’s what liz does. The system provides information on the time it takes to answer a question, where the application was abandoned if that’s the case, if answers are changed, and other behavioral markers. We do this for two reasons. First, it provides valuable information on problematic questions; but it also tracks troublesome actions by applicants. If one-third of all applicants quit the application at a specific question, the business can see the roadblock and can edit or remove that question. Identifying friction along the journey is the only way to target and eradicate it, this ensures a faster, more enjoyable journey .

Learn more about our customer journey optimization in The value of transparency in a customer journey.

The best part is edits can be made in seconds by anyone with the right permissions. Change or remove any problematic question, change it again, or change it back. You’re finally able to have full control over every question in the customer journey. This level of flexibility means you can react quickly and decisively when required. No more filling out tickets and waiting for someone to get back to you so they can make that change. The business can experiment with wording questions in different ways to test the system and gather observations.

Last, some organizations out there have data scientists on staff that, due to data security or geographies, simply can’t access the data for them to analyze. With our liz suite, thinktum’s expertise and experience can help resolve many of these issues. We can ensure your data science teams have secure and structured data to maximize their ability to deliver the most robust data analysis possible.

We start with why and recommend you do the same

Understanding which data are important, which to collect, and which can contribute to a specific purpose can have many benefits across the organization, including:

- Improving the customer journey, for advisors and customers alike

- These data can be tied directly to increasing revenues

- Your quality of business improves

- A decrease in non-disclosures, misrepresentation, and fraud

- An increase or improvement in placement and business retention

- Tying data directly to profitability

There is also the quality of data to consider. When a company just dumps all of their data into an online bucket to ignore until the next quarter, how valuable can that data be? Can underwriters and other business staff separate the wheat from the chaff? What if it’s all chaff? As with anything, data is only useful when it’s used; but asking staff to analyze it and pull recommendations becomes a fool’s errand.

We understand there is a lot to consider when it comes to upgrading technology or adding on functionality such as our liz suite. The truth is, our modular solutions simply sit on top of any existing infrastructure, it doesn’t even interact with the existing software systems.

Best of all, liz provides both a frictionless customer journey, as well as vigorous data analysis. At thinktum, we believe the journey is everything for the applicant, while the data is everything for the organization. And yes, you can have them both.

To better understand how your business cycle can reflect your very own mix, read Of risk appetite and underwriting philosophy.

Reach out to us today to get started.